Recognizing LLCs: Key Truths and Advantages

An LLC, or Limited Liability Company, is a prominent organization structure among business owners throughout numerous sectors. This sort of firm incorporates the restricted responsibility attributes of a corporation with the adaptability and tax efficiencies of a collaboration. Establishing an LLC can be a calculated move for local business owner that look for to secure their personal properties from service debts and responsibilities. Unlike sole proprietorships or collaborations where individual and business properties are legitimately the very same, an LLC supplies a lawful separation. This splitting up indicates that in case of legal actions or organization debts, personal assets like homes, autos, and various other valuables are safeguarded. LLCs are additionally reasonably very easy to establish and preserve contrasted to corporations, making them an appealing choice for tiny to medium-sized enterprises.

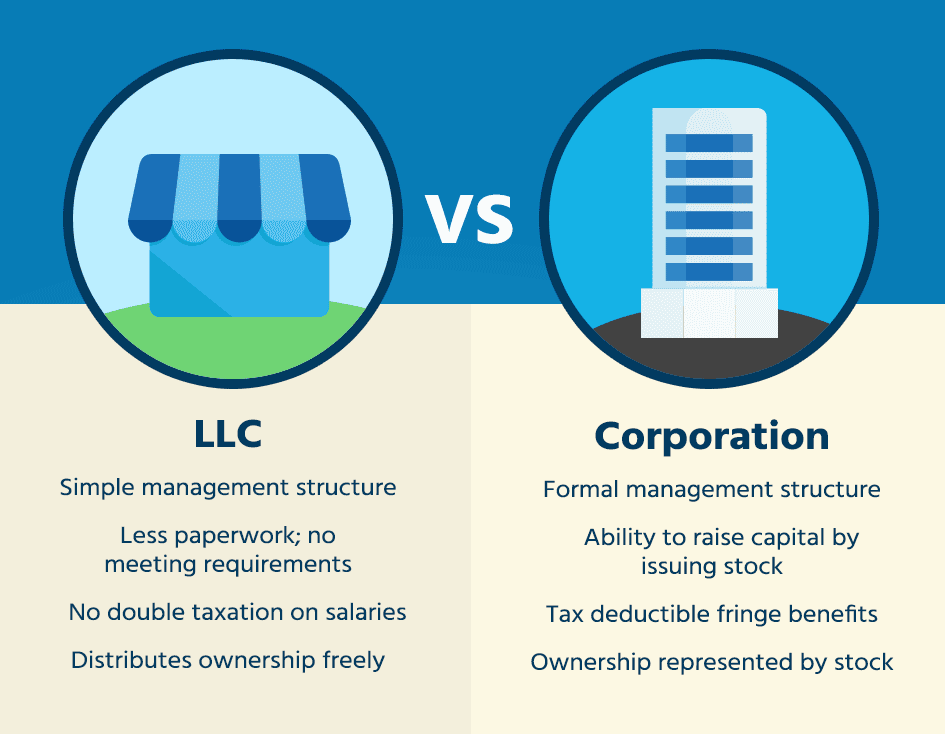

Among the most appealing facets of an LLC is the taxes flexibility it uses. Proprietors of an LLC can select to be strained as a single owner, a partnership, or a corporation, relying on what is most useful for their scenario. This selection permits substantial strategic planning in terms of fiscal administration. LLCs do not need an official management framework as firms do, providing members the liberty to operate in a way that finest suits their service version. This flexibility prolongs to the variety of proprietors (members) an LLC can have; there is no maximum number, and participants can consist of individuals, other LLCs, and also companies. An additional benefit is the convenience of transfer of ownership, which can be more uncomplicated than in various other business formats, offering beneficial choices for organization continuity and heritage planning.

Comprehending the Structure and Benefits of Limited Obligation Business (LLCs)

A Limited Obligation Company (LLC) is a preferred organization structure in the USA as a result of its flexibility and the protection it offers its owners from individual responsibility. Basically, an LLC is a hybrid entity that incorporates the pass-through taxes of a partnership or single proprietorship with the minimal responsibility of a company. This framework permits revenues and losses to go through to the proprietor's individual income without encountering corporate tax obligations, while additionally protecting individual assets from business financial debts and liabilities. Developing an LLC is normally simpler and entails less paperwork than creating a company, making it an attractive choice for small to medium-sized organizations. The owners of an LLC are referred to as participants, and there can be one or numerous members in an LLC. Members might include individuals, various other LLCs, and even corporations, depending on state regulations. cleaning business description of the considerable advantages of an LLC is the adaptability in monitoring. Unlike firms, which should stick to a stringent monitoring framework, LLCs can be handled by the participants (recognized as member-managed) or by selected managers (manager-managed), which can consist of outsiders or participants. This flexibility allows the LLC to be tailored to the details requirements of business and its participants. Another benefit is the lack of constraint on the variety of members, which can consist of people, corporations, other LLCs, and international entities. This inclusivity makes it a versatile choice for a diverse variety of service tasks. The existence of an LLC can proceed constantly, or the members can define a dissolution date in the Articles of Company. The adaptability and security features of the LLC make it among one of the most recommended forms of service frameworks readily available today, stabilizing the simplicity of a partnership with the safety of a company.

Understanding the Framework and Benefits of an LLC

When considering the framework of a Limited Responsibility Business (LLC), it's important to recognize its one-of-a-kind setting in the business globe that blends aspects of both partnerships and firms. An LLC is a prominent choice for lots of business owners because it supplies liability defense to its proprietors, recognized as members, which means that when it comes to business failure or claims, the personal possessions of the participants are generally shielded. Since it supplies a guard against personal financial risk while providing flexibility in administration and earnings distribution, this structure allures to medium-sized and tiny service proprietors. Unlike firms, an LLC is not required to have a board of directors or hold annual conferences, which can reduce and streamline procedures paperwork. An LLC can pick to be exhausted as a sole proprietorship, partnership, or company, giving critical versatility for optimizing tax obligation obligations based on the certain financial circumstances and goals of the business. The capacity to draw in investment is one more substantial benefit of an LLC. Investors are typically extra happy to money organizations that use obligation defense and have a clear, organized management system. In addition, the reputation connected with the LLC structure can boost a business's standing with consumers, vendors, and partners. Finally, establishing an LLC can be reasonably uncomplicated, with fewer requirements and reduced preliminary costs compared to corporations, making it an available alternative for numerous brand-new entrepreneurs.

Comprehending the Framework and Benefits of LLCs

Minimal Responsibility Business (LLCs) are a popular service structure among business owners across numerous markets, using a blend of flexibility and defense. This hybrid entity combines the pass-through tax functions of a collaboration with the restricted liability advantages of a firm, making it an attractive option for numerous company owner. Among the primary benefits of an LLC is the security it provides to its participants from individual obligation. This suggests that in the case of organization debts or suits, the personal possessions of the participants, such as their autos, homes, and savings, are generally secured. An additional substantial advantage is the flexibility in administration. Unlike corporations, LLCs are not needed to have an official board of supervisors or hold regular conferences, which can lower administrative burdens and improve operational flexibility. Taxes is one more area where LLCs provide significant benefits. They are typically subject to pass-through tax, where the business's earnings are not taxed at the business degree yet are gone through to specific members to report on their individual income tax return. This structure aids stay clear of the dual taxation typically associated with corporations, where profits are tired both at the company and shareholder degrees. LLCs supply substantial versatility in how profits are dispersed amongst participants. They are not called for to disperse profits similarly or according to possession portions, permitting participants to tailor profit-sharing contracts to satisfy their details demands. The procedure of establishing an LLC varies from state to state, however it normally includes filing the Articles of Company with the state's assistant of state and paying a declaring fee. Operating arrangements are not necessary in every state, they are highly recommended as they describe the monitoring framework and operating treatments for the LLC, aiding and providing clear guidelines to stop disputes amongst members. Additionally, while LLCs do offer several securities and benefits, they are not appropriate for each company type. Services seeking to increase capital via public supply offerings could locate the company structure more valuable. Finally, LLCs stand for a functional and efficient business framework that balances the convenience of management with durable individual possession protection and desirable tax obligation therapy. Their adaptability makes them appropriate for a wide variety of organization tasks, however entrepreneurs ought to consider their details company requirements and speak with legal and economic experts to make certain that creating an LLC is the most beneficial choice.

Recognizing Limited Obligation Business (LLCs)

At the heart of small service structuring in the USA, the Limited Liability Firm (LLC) stands out as a popular selection as a result of its flexibility and security benefits. This service entity integrates the pass-through tax of a collaboration or sole proprietorship with the minimal liability of a corporation, making it an eye-catching alternative for company owner. An LLC is legally taken into consideration a separate entity from its proprietors (called participants), which shields those participants from personal responsibility in a lot of circumstances. This means that when it comes to financial debt or legal concerns, the individual assets of the members, like cars or residences, typically can not be targeted to clear up service obligations.

Creating an LLC entails numerous actions, consisting of choosing an unique name for business, submitting posts of company with the appropriate state agency, and paying needed state charges. These requirements can differ significantly from one state to one more, which is why several possible local business owner get in touch with lawful or economic professionals during the setup procedure. Operating contracts are another essential component of developing an LLC. Although not needed in every state, these files describe the administration structure of the company and set the policies and treatments that control participants' communications to assist avoid future conflicts.

Among one of the most appreciated advantages of an LLC is the adaptability in management. Unlike firms, which are called for to have an official structure with officers and directors, an LLC can be handled by its members or by supervisors that might not be members. This can be particularly useful in scenarios where the proprietors wish to work with outside managers to deal with business operations. Additionally, the tax structure of an LLC is inherently versatile, providing the ability to pick how they are taxed, which can cause considerable financial advantages. For example, an LLC can elect to be tired as a sole proprietorship, collaboration, S corporation, or C corporation, offering significant adaptability in economic planning and potential tax savings.

In spite of these advantages, operating an LLC also comes with its challenges. The level of paperwork and the requirement for continuous compliance with state guidelines can be discouraging for new entrepreneur. An LLC's operational procedures and versatility might confuse entrepreneurs unknown with business law. As always, it is recommended to seek expert advice when establishing an LLC to make certain that all lawful demands are met and kept, therefore safeguarding the benefits of the LLC structure for the security and prosperity of the service.